What is your relationship with money? Are you the type that saves for a rainy day? Or do you have fun spending money as soon as you get it? Who do you trust when it comes to financial advice? Answering these kinds of questions can be helpful determining who you are when it comes to finances.

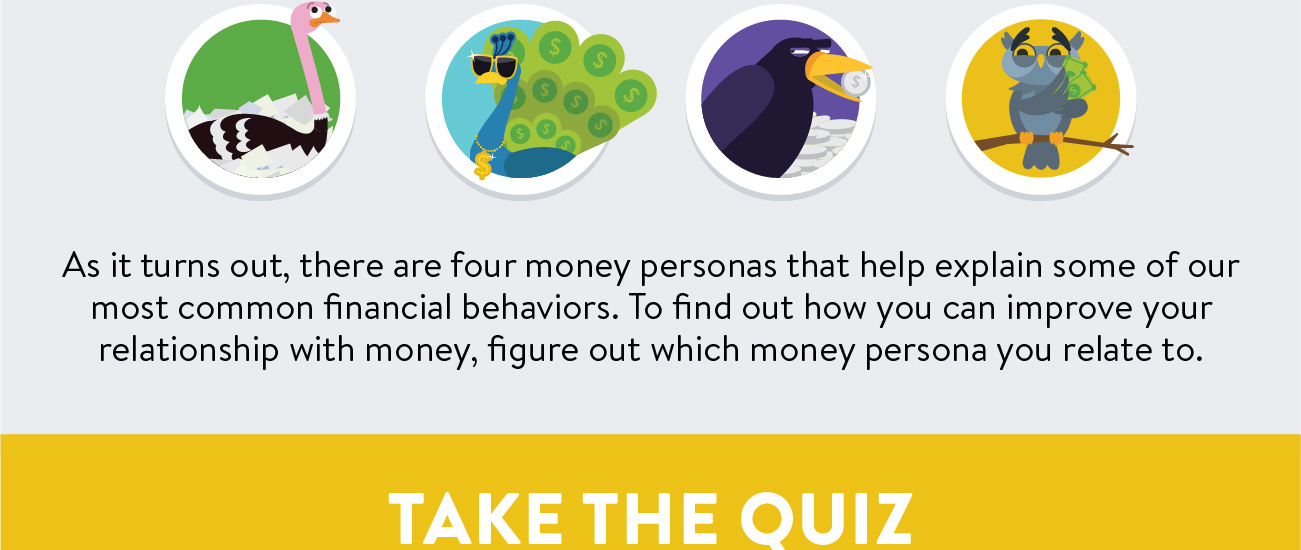

We've come up with four different personality types that describe some of the most common financial behaviors. Watch the video, take the quiz and discover which category you fall into. After all, understanding yourself is one of the first steps towards financial success.

Advice Source: Parents and family members

What it says about you: Responsibility is important to you, and you believe that big decisions should only be shared with people you absolutely trust.

Why it’s great: Recent studies have found that 49% of Millennials turn to their parents for financial advice. It’s not hard to see why—family members have a trust factor that just can’t be rivaled by any financial institution. They’ve known you literally since you were born and they truly have your best interests at heart. They’re familiar and accessible and, since they’ve guided you through most aspects of life, it makes sense that they guide you through your finances too.

Where it’s lacking: No two families are alike. In some households, money is talked about casually and in others the topic is totally taboo. Some parents are fully involved in teaching their children about money; others get stressed out even thinking about it. Parents are an excellent resource if they’re money-savvy and if they’re comfortable talking to you about finances. If that’s not the case, then you might want to look for other sources of financial information before consulting with mom and dad.

Advice Source: Financial advisor/planner

What it says about you: You value expertise in decision-making, and you’re not afraid to ask for help from a professional.

Why it’s great: Whether you consult with an advisor at your financial institution or hire an advisor independently, it’s hard to top the results you get from working with a dedicated professional. Having an expert assess your financial situation and design a plan for you is an extremely powerful tool because they can recommend products, services and strategies that you might never have come across on your own.

Where it’s lacking: Many young adults shy away from this advice source. One possible reason is because, as helpful as a financial advisor can be, reaching out to one can be intimidating if you’re used to your finances being a very private matter. Maybe you feel embarrassed about your current level of financial understanding, or maybe you’re not used to talking about money. Using some other sources on this list to gather information before meeting with a planner can help you feel in control and better prepared.

Advice Source: Personal finance blogs/online forums

What it says about you: You value privacy when it comes to your finances, and you know that research is critical before making any important decisions.

Why it’s great: It’s fast, it’s specific and it’s private—the Internet is great for financial guidance. Some helpful online resources include your credit union’s website, personal finance blogs geared toward your life stage, personal finance sections on news sites, and FAQ sections or forums on popular financial websites.

Where it’s lacking: As with all online content, you need to have a critical eye when gathering data. Who’s the author of the content? What’s their motivation? Is this review biased? Is that research trustworthy? When you use the Internet as your go-to information source, it’s up to you to sift through all the sites and articles to find the content that’s most relevant to you. Getting a second opinion (or better yet, a professional opinion) on a topic you’ve been researching is a great way to get more comprehensive advice.

Advice Source: Friends and peers

What it says about you: Maintaining the status quo is important to you. You feel most confident with decisions that align with what others are doing.

Why it’s great: Friends and other peers can be a good place to get financial advice—they’re typically in the same age range, they may be facing some of the same financial challenges or situations as you, and they might be easier to talk to than your family. They’re believable role models and can serve as good examples of what certain products, services or financial habits look like in practice.

Where it’s lacking: Even the closest of friends can have dramatically different financial backgrounds. When you go to your friends for financial advice, it’s very easy to compare yourself to them, which in some cases, can do more harm than good. Everyone has a unique set of financial priorities and circumstances. Getting general financial advice from your friends is great, but when it comes to more specific advice, look elsewhere.

Advice Source: Apps

What it says about you: You value efficiency and are always looking for ways to improve and upgrade daily tasks.

Why it’s great: Personal finance apps are wonderful resources because they’re often better at slotting into our busy schedules than some of the more traditional approaches to learning about personal finance. Why bother researching different budgeting systems when a comprehensive budgeting app is just a download away? Convenient and well-designed apps that fill a real need can actually lead you to pay more attention to how you manage your money.

Where it’s lacking: Personal finance apps are usually geared more towards actions than they are to education. They’re a great way to check an account balance on the fly or to set up a budget, but they don’t always provide the education that goes along with those tools. Apps are awesome tools that tend to work best when combined with a broader understanding of financial topics.

________________

Also consider how your credit union can help you further your financial knowledge. If you were to draw a diagram of your financial advice sources, your credit union would sit quite comfortably in the middle. It may not be related to you, but your credit union does have your best interests in mind as a member-owner. Your credit union can also provide you with current, professional advice and can give you access to all sorts of additional resources—both online and in person. It’s worth checking out, especially if your current combination of financial resources isn’t quite making the cut.

Downloads

Handout

Infographic

Related Products & Services

Share Savings

Dedicated Savings

Cash Flow Calculators

Mobile Banking

We're Here to Help You

At America First Credit Union, our chief concern is the financial well-being of members. We strive to provide superior products and services and strengthen the communities we serve.